KYC LEGAL BLOCKCHAIN IDENTITY VERIFICATION

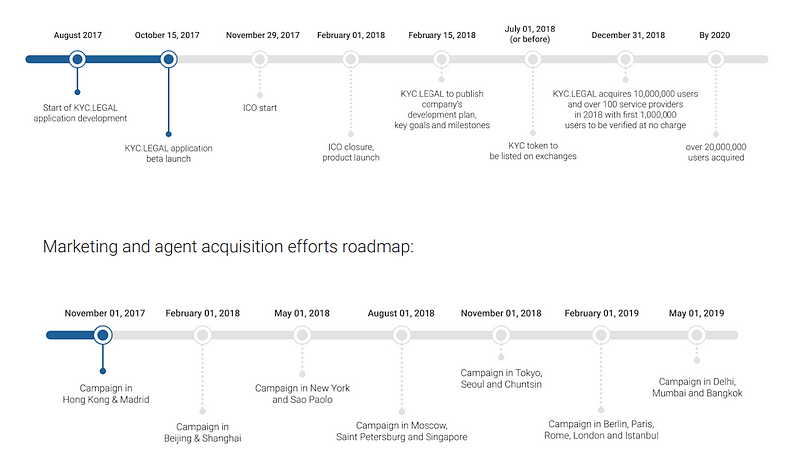

The cryptocurrencies has taken the business world like a storm. People are busy working on different mechanisms to make the world a better place through the instrumentality of modern technology. With the price increasing rapidly large number of people are trying to get in and ended up stuck in the process of verification, and the system just can’t handle it. Team behind https://kyc.legal/en came up with and idea to make that process faster and safer.

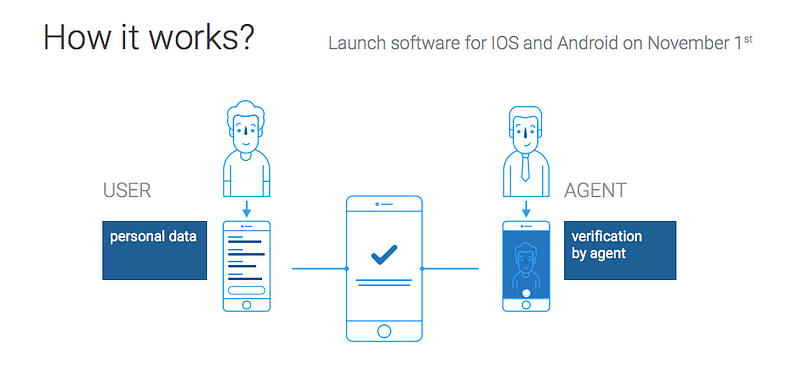

KYC (Know Your Customer) Legal is a blockchain based verification service that is looking to prevent frauds while validating personal data.

Instead of waiting for couple of weeks, or even months in some cases, for only 10 to 50 USD, KYC legal can finish the verification process in just under 30 minutes. All the personal information is stored on users device with encryption to secure the privacy.

Instead of waiting for couple of weeks, or even months in some cases, for only 10 to 50 USD, KYC legal can finish the verification process in just under 30 minutes. All the personal information is stored on users device with encryption to secure the privacy.

Obviously, it is not gonna be a free service but at the same time even when you’re doing this as a business it’s never free you’ve still got the security issues you still got a cost that is in the business somewhere so businesses will pay for it because it removes of that issue that exists on storing this information but also it means that they are personally checked somebody would like for example come to my house. Can I take a picture of myself to send it to them to say yeah I own KYC legal service my picture is sent to the agent they selected in my local area. I then go and weather so they come to me they look at me yeah that’s him, look to driver license, look the passport validate the information this is this person and then obviously that is validate on the system. The agents also have a more intense verification investing purpose so all in all this will be a very good system. There will be locations that won’t reach everywhere in the beginning but the fact is we focus on place of London all the major cities which they’re looking doing if we have a look through their whitepaper, they are already hitting the big area is where there know going to have a lot of customer usage not only from paper one their information stored. So, they don’t constantly have to keep putting their information everywhere. every time you go to exchange you are going to be asked passport photo, utility bill you’ve got to have all this information but every time you send it somewhere is at risk of another person hacking and stealing it.

So, having KYC legal deal with these issues, in theory your information should only be with them. You shouldn’t need it all over the internet you shouldn’t need to constantly be signed up here there another everywhere with all your day to be spread around because it defeats the object. Because if somebody hacks into one of these and got a copy of passport, your driving license, utility bill they can have another account somewhere else but with KYC legal that wouldn’t be possible. So, I would say much better system, good idea and I can say being one of those I see as that will actually go off and make a good business. They have already past their soft cap which is also a very good sign is one to be worth investing in because they are already at the point where they can make a completely up and running as quickly as possible and get in a good ROI on it as well as an investor.

For users

-Personal information is protected by encryption and biometric data

-Data is hosted on user’s device

-User is able to choose information provided to service

-Document verification with digital sign

-Personal information is protected by encryption and biometric data

-Data is hosted on user’s device

-User is able to choose information provided to service

-Document verification with digital sign

For services

-Reliable information on user

-Absence of fake or dublicated user profiles

-KYC (Know Your Customer) compliance

-Ecosystem for customer and service interaction

-Reliable information on user

-Absence of fake or dublicated user profiles

-KYC (Know Your Customer) compliance

-Ecosystem for customer and service interaction

ID verification market

We live in a brand new digital world. More than that, we are the grassroots of Web3, experiencing increasing power and influence of Blockchain-based technologies on our day-to day life. According to recent MarketsandMarkets 2 report, Blockchain technology market size will be worth 2.3 billion by 2021, increasing at a compound annual growth rate (CAGR) of 61.5 percent. Within Blockchain, the digital identity market is expected to grow at the highest rate as the Blockchain would make digital identities more secure and efficient, resulting in seamless sign- ons and a reduction of identity fraud. In addition, the global Identity Management market worth is projected at $14.82 billion by 2021, up from $8.09 billion in 2016.

Business-model

Blockchain technology for personal identification

The diversity of middlemen and the lack of value-added to service providers and users make some sort of simplification of the present online ID verification system inevitable. The reality remains: user experience is valuable, but it hasn’t been properly improved with an efficient and transparent service. According to Customer Due Diligence 14 (CDD) Market Survey 2016 performed by Nice Actimize, Fi — nancial Services Organizations are facing an increased need to evaluate and enhance organizational CDD/KYC controls in order to address the new regulatory requirements. Top operational challenges related to current CDD/KYC are manual processes and data quality & availability, and the highest operational priorities related to CDD/KYC programs are to improve data quality, investment in new technology solutions and process automation.

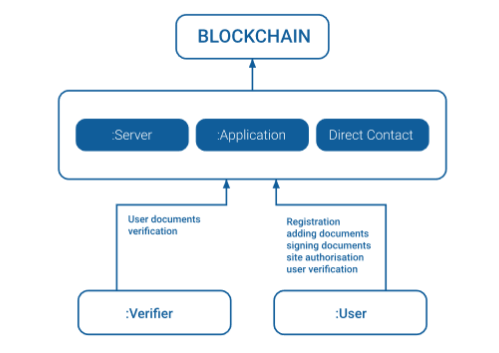

General view of the whole system:

Blockchain base can be accessed in three different ways:

1. Direct appeal. Direct contact to a Smart Contract on Solidity. Our Smart Contract pos — sesses a communication interface that can be interacted with without a server or app (e.g. to check another user or see a list of verifiers).

2. Appeal through the server API. Services can communicate with system users via an API in order to verify their own users through KYC. The API provides a QR-code to the service that allows you to request personal information from the service and identify it.

3. Mobile application. The mobile application exchanges data with the database through the server API. This is used as the primary way to interact with the system and is avail — able to all users.

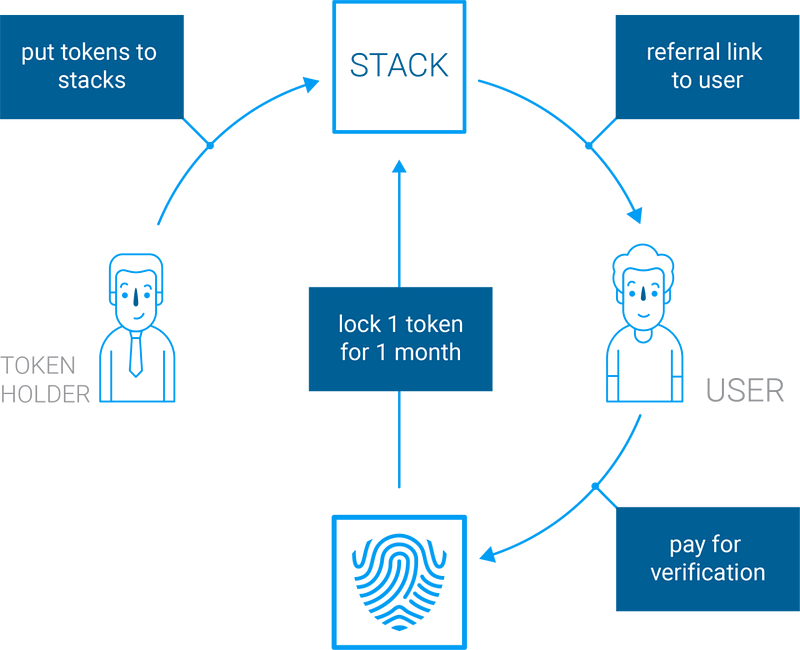

Economics

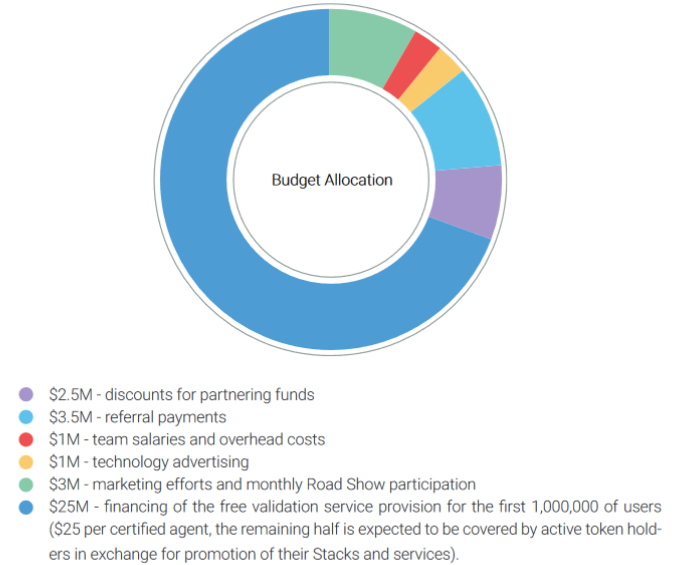

With new digital economies booming and the volume of ID verification requests growing at unprecedented rates, KYC.LEGAL is aiming to execute its unit economics through data moneti — zation while sacrificing our potential ID verification revenues in order to accelerate user growth. (remember? 50% to certified agent and 50% is split between token holder and user discount)

For scale estimation, let’s take our ICO example. Out of a maximum of 42,000,000 issued KYC tokens, a conservative forecast is that every 4th token will conduct at least one verification per year bringing its holder $12 on average. This gives us $100-$120M in total revenue for all token holders during year 1 — given that potentially token holders will cumulatively invest not more than the $35M max cap, it’s over a 300% increase.

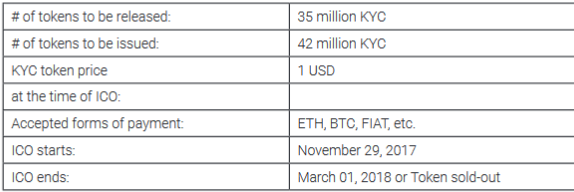

Token Sale

KY C is an Ethereum token which authori zes the usage of all KY C appservices. Tok en gene ration means gener ation andex change of KYC between ICO participants. Tok ens will be released and distributed within 7 da ys after the ICO closure. The offer is opened to the global community ex cluding U.S. citizens, whoae pr ohibited by the law of their country to tak e par t in such activities. KY C.LEGAL is not responsible for members who violate ICO-related laws of their country of citizenship.

Initial Coin Offering

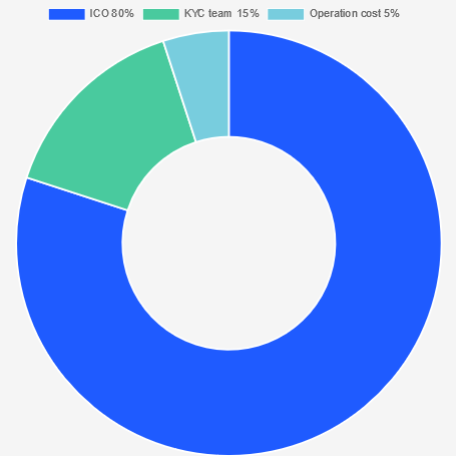

Token Distribution

KYC.LEGAL releases 35M KYC tokens at a value of $1 per token during the ICO timeframe with a max cap of $35M. The KYC.LEGAL team additionally issues 20% of the released amount — 15% to be withheld by the KYC.LEGAL team and 5% to cover ICO operational costs. The total amount of tokens issued is 42M.

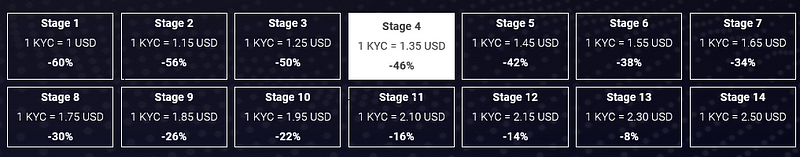

Token KYC Price includes

Verifying Agent’s costs from $5 t o $25 (depends on region) Rewar damoun t (50% of t otal pri e) can be shared between User and Tokenholder Rewar d sharing process is managed by Tokenholder only KYC t oken works as the sharing instrumen t and it means utility token (not of ten)

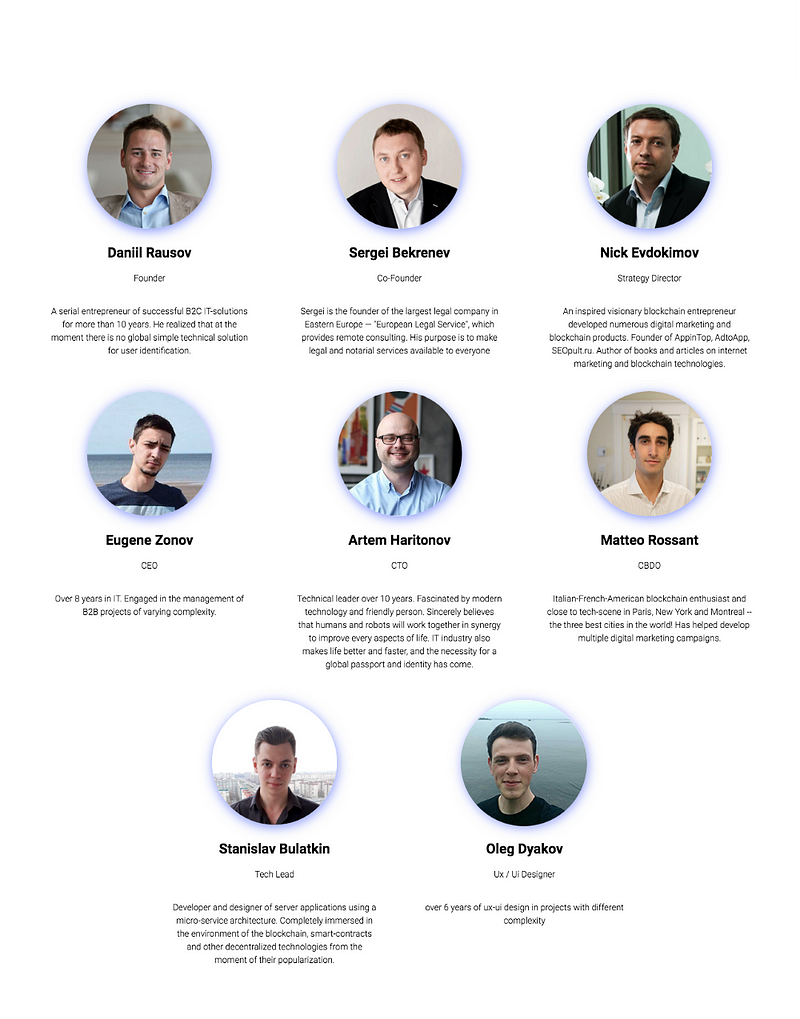

The Team

Curious about KYC Legal? Watch here:

For more information please visit:

Official web page : https://kyc.legal/

Whitepaper : https://kyc.legal/WhitePaper-ENG.pdf

Twitter : https://twitter.com/KYCLegal

Telegram : https://t.me/KYCLEGAL / https://t.me/KYCLEGALru

Facebook : https://www.facebook.com/KYCLegal/

Whitepaper : https://kyc.legal/WhitePaper-ENG.pdf

Twitter : https://twitter.com/KYCLegal

Telegram : https://t.me/KYCLEGAL / https://t.me/KYCLEGALru

Facebook : https://www.facebook.com/KYCLegal/

Profile: https://bitcointalk.org/index.php?action=profile;u=994438;sa=summary

Eth : 0x44d86c22BE3671e37f0B7D84CC7f38DAA4F7AD99

Eth : 0x44d86c22BE3671e37f0B7D84CC7f38DAA4F7AD99

Komentar

Posting Komentar